Genting Hong Kong Defaults on loans

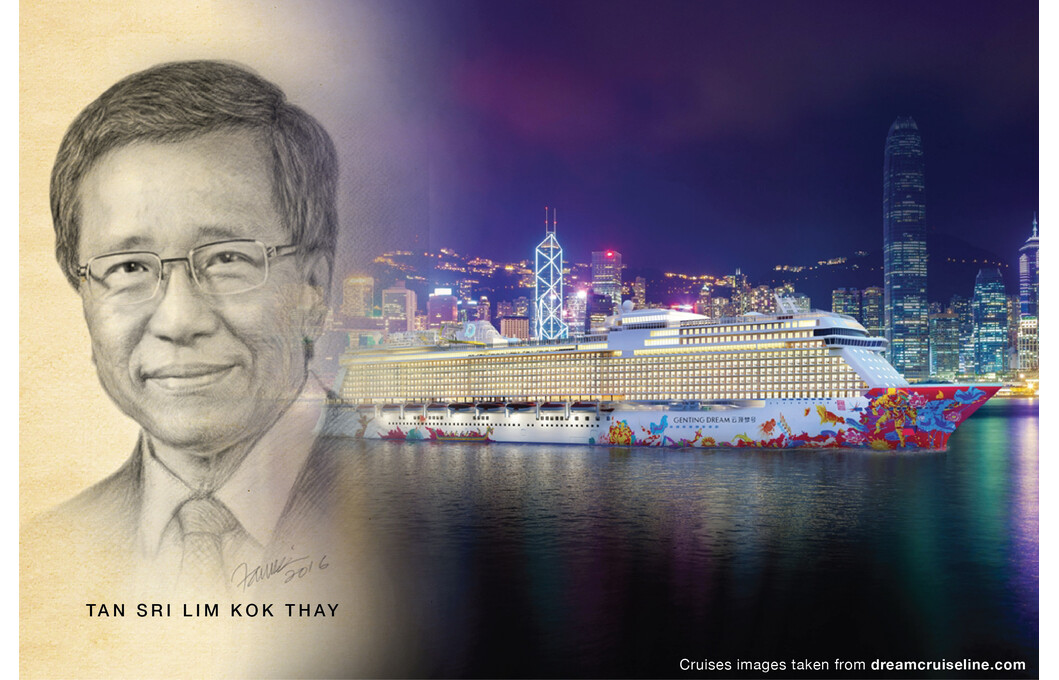

These are trying times for Tan Sri Lim Kok Thay (KT Lim), Chairman of Genting Malaysia Berhad (GentingM) until 27 August 2020, when he was redesignated as Deputy Chairman. The position was switched with Tan Sri Alwi Jantan (formerly Deputy Chairman) who is now Chairman of Genting Berhad. Tan Sri KT Lim remains the Group CEO. His son Lim Keong Hui, who was Deputy CEO of Genting Hong Kong (Genting HK) which owns the luxury cruise lines, resigned from the Board of Genting Hong Kong and from his post as Deputy CEO on 28 August 2020 in the midst of a major restructuring of the debts of Genting HK which is about US$3.4 billion as of July 31 2020. The vacancy was filled by a veteran of Genting HK, Colin Au who was founding President and CEO of Star Cruises (now Genting HK) 27 years ago when the company was a pioneer in the Asia Pacific cruise industry.

Genting HK had issued warnings in early August 2020 of mounting losses due to the suspension of its global cruise liners and shipbuilding operations in Germany as a direct result of the covid-19 pandemic. It sent signals out that it anticipated at least a $300 million operating loss and at least a $600 million consolidated net loss for the six months ended 30 June 2020. Genting HK owns Dream and Star Cruises which operates in Asia and Crystal Cruises which has two global cruise ships. The pandemic has effectively dried up all its revenue generating leisure and cruise operations leading the company to announce on 19 August 2020 that it was suspending payment to creditors when two shipbuilding loans fell due. It signified a default by a borrower. The company’s share price plunged 38% in a major sell off by jittery investors a day after the announcement. A member of the Genting group defaulting on its financial obligations came as a shock to Malaysians only because it was quite unthinkable until it happened. Maybank is reported to have about US$300 million committed to Genting HK while RHB has US100 million. According to Bloomberg, Tan Sri KT Lim has been pledging more of his holdings as the shares have plunged, committing almost all of his 76 per cent stake or six billion shares in Genting Hong Kong and about 32% of his holdings in GentingM as collateral to lenders. Hopefully there is no further margin call to top up.

For investors, it is necessary to know that Genting HK is not part of Genting Berhad in terms of shareholdings. The majority of Genting HK shares is held personally by Tan Sri KT Lim.

Questions have been asked as to why Lim Keong Hui resigned at a time when his father is holding the fort and trying his utmost to steady the ship? Young captains who sail through stormy seas develop the experience to navigate and avoid shipwrecks. At this time when creditors and investors are jittery, the world looks at what the family will do. It is a positive thing that Keong Hui has bought the financially stressed Zouk Group in Singapore for S$14 million off Genting HK (2 September 2020) to stop bleeding the parent and to provide extra cash for operations. But this is the time to stand side by side with his father to hammer out an interim and a longer restructuring plan with creditors and bankers to save the embattled cruise business of Genting HK. Captains are always the last to leave. Keong Hui is groomed for succession as evidenced by his elevation to top positions at the Genting Group in recent years. On 1 January 2019 he was promoted to Deputy Chief Executive and member of the EXCO of GentingM and Deputy Chief Executive and Executive Director of Genting Plantations Berhad (GentingP). On 28 March 2019 he was appointed the Deputy Chief Executive of Genting HK till he resigned on 28 August 2020.

As Tan Sri KT Lim faces the greatest corporate challenge of his life since he took over the helm of the Genting conglomerate from his father, the late Tan Sri Lim Goh Tong in 2004, he will know who his friends are and how rough it will be to face unhappy creditors. It is a part of the journey that many seasoned businessmen have gone through. Look at Masayoshi Son of Softbank. At one stage when he was bashed with the WeWork crisis on a massive scale, things looked dim but right now Masayoshi Son is riding high again. Stormy seas and impending shipwrecks test the character of the captain. Many have faltered and sunk while others have emerged stronger and wiser. But all have scars and unpleasant experiences.

Investors who are holding on know that Genting HK is not the only business of the Lim family and that the catastrophe faced by the company is wrought by an external source that has devastated everyone in the same industry. Others may not have the comfort that a family of fortune is at the helm. The GentingM group has been a cash cow for investors and the Lim family for decades. Genting Singapore Ltd is also cash rich with S$3.4 billion in net cash. While the pandemic looks downright gloomy at this time, the discovery of a vaccine in the near future could suddenly lift the dark clouds and change everything. The holiday makers may come back again in droves or they may not because of the new normal and social distancing. But there is hope that things can turn around. People cannot stay cooped for lengths of time.

Genting Malaysia Berhad

While Tan Sri KT Lim is battling at the Genting HK frontline, it is not all roses for Genting M and its vast investments overseas. The pandemic is worldwide. (story will continue next week)

Read more

- The Star Online. Wong SuLong. Smooth Changeover at Genting. https://www.thestar.com.my/business/business-news/2004/01/01/smooth-changeover-at-genting

- TTG Asia. 2 September 2020. Genting HK sells Zouk Group for US$10.2 million. https://www.ttgasia.com/2020/09/02/genting-hk-sells-zouk-group-for-us10-2-million/

- Seatrade Cruise News. 28 August 2020. Colin Au moves up to Deputy CEO, Genting Hong Kong. https://www.seatrade-cruise.com/people-opinions/colin-au-moves-deputy-ceo-genting-hong-kong

- The Standard. 2 September 2020. Genting Hong Kong offloads nightclub operator Zouk to conserve cash. https://www.thestandard.com.hk/breaking-news/section/2/154477/Genting-Hong-Kong-offloads-nightclub-operator-Zouk-to-preserve-cash

- The Edge Markets. 28 August 2020. Chong Jin Hun. Lim Kok Thay redesignated as Genting Malaysia Deputy Chairman. https://www.theedgemarkets.com/article/lim-kok-thay-redesignated-genting-malaysia-deputy-chairman

- The Maritime Executive. 2 September 2020. Genting Defaults and Suspends payments as it seeks to refinance. https://maritime-executive.com/article/genting-defaults-and-suspends-payments-as-it-seeks-to-refinance

- The Malay Mail. 21 August 2020. Syed Jaymal Zahiid. Genting Boss commits own stake for Hong Kong’s unit’s loans as pandemic takes toll on business. https://www.malaymail.com/news/money/2020/08/21/report-genting-boss-commits-own-stake-for-hong-kong-units-loans-as-pandemic/1895767

- The Edge Markets. 20 August 2020. Kathy Fong. Cross default unlikely in Genting Group as Genting HK suspends payments to lenders. https://www.theedgemarkets.com/article/cross-default-unlikely-genting-group-genting-hk-suspends-payments-lenders

- The Business times. 21 August 2020. Genting Hong Kong suspends payments to creditors. https://www.businesstimes.com.sg/companies-markets/genting-hong-kong-suspends-payments-to-creditors

- The Business Times. 2 September 2020. Rae Wee. Genting Singapore in stronger position than Genting HK: analysts. https://www.businesstimes.com.sg/companies-markets/genting-singapore-in-stronger-position-than-genting-hk-analysts

- Genting Berhad Annual Report 2019. The Genting story. https://www.genting.com/history-2/

- South China Morning Post. 18 September 2015. Langi Chiang. Genting HK to acquire German shipyard operator to speed up fleet expansion. https://www.scmp.com/business/companies/article/1859288/genting-hk-acquire-german-shipyard-operator-speed-fleet-expansion

- South China Morning Post. 21 August 2020. Tashny Sukumaran.Will Genting’s Hong Kong plight affect its units in Malaysia, Singapore amid the Covid-19 Pandemic? https://www.scmp.com/week-asia/economics/article/3098373/will-gentings-hong-kong-plight-affect-its-units-malaysia