Tan Sri David Kong & the CVC stake in Nirvana

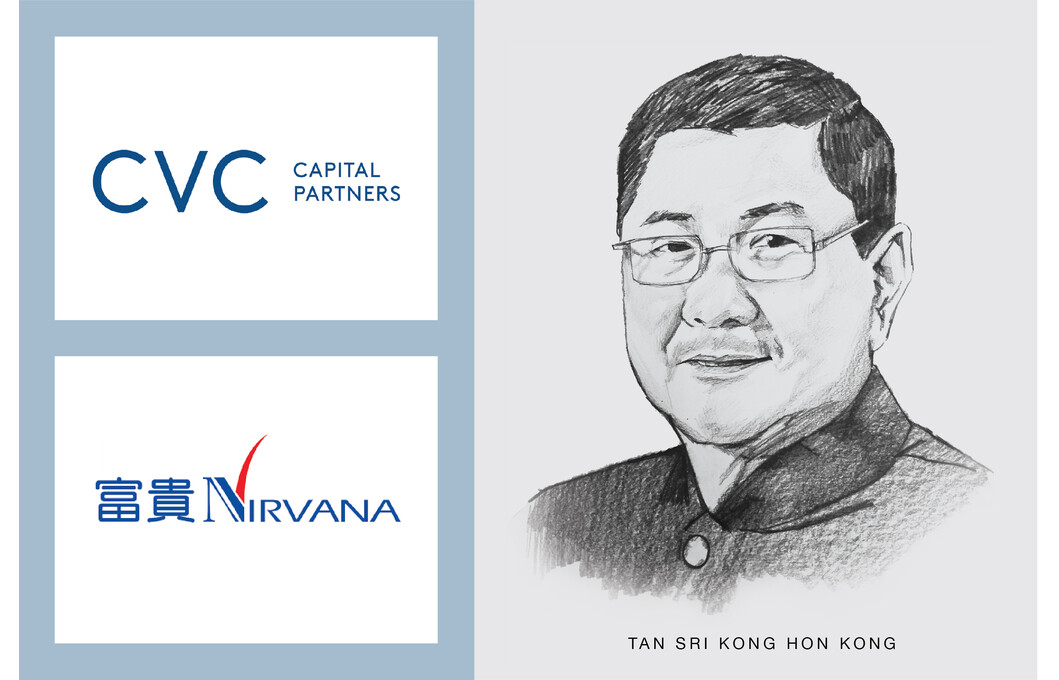

Founder of Nirvana Asia Ltd, Tan Sri David Kong Hon Kong, 66, has come a long way from being the son a poor rubber tapper family in Kuala Lipis, Pahang to become one of the richest men in Malaysia. Forbes stated his net worth as US$900 million as at 3 April 2020. In 1990 he established Nirvana Memorial Park in Seminyih, Selangor on 323 acres of former plantation land. On 3 August 2000, he listed Nirvana as NV Multi Corporation on the Main Market of Bursa Malaysia (then the Kuala Lumpur Stock Exchange). In an interview with the Star newspaper, Tan Sri David Kong said, “I simply had a dream to provide seamless, worry-free death services, It has made me more money than I ever dreamt.” The genesis of that dream began when he had difficulties giving his father-in-law a decent burial, the kind that Nirvana today provides. There is great satisfaction, both sentimentally and financially, in the realisation of all his efforts over the years to do what he had set out to achieve.

In 2012, Tan Sri Kong took NV Multi Corporation Berhad private and the company was delisted from Bursa Malaysia. Thereafter he sought a listing of Nirvana Asia Ltd on the Hong Kong Stock Exchange (HKEx) to raise HKD2billion (US$261 million) to aggressively expand in Asia. Private equity firms Orchid Asia Group and AIF Capital Asia IV invested in Nirvana Asia pre-IPO with respective stakes of 21.6% and 10.7%. Nirvana Asia Ltd was successfully listed on the HKEx on 17 December 2014. This strategic made Tan Sri Kong a very much richer man besides remaining the controlling shareholder. Nirvana Asia became the largest integrated death care service provider in Asia, in terms of contract sales, revenue and land bank according to a 2013 report by Frost & Sullivan.

CVC Buyout of Nirvana Asia

Then in July 2016 private equity firm CVC Capital Partners made a $1.1 billion buyout offer, in cash and shares, to Nirvana Asia Ltd. CVC’s offer in cash and shares were made to Tan Sri Kong’s company Rightitan Pte Ltd which then owned 42.7 percent of the company, and Orchid Asia Group Management, which held a 21.6 percent stake. For others, the buyout offer was in cash. The deal marked the first ever public-to-private transaction on the HKEx completed by a private equity firm. Established in 1981, CVC is a world leader in private equity and credit with US$105.1 billion of assets under management, $160.3 billion of funds committed and has a global network which includes 8 offices in the Asia Pacific region. It is majority owned by its employees and led by a team of Managing Partners. Shareholders comprising 99% of the holders of Nirvana Asia Ltd voted in favour of the buyout on 28 September 2016. In October 2016 Nirvana Asia Ltd was privatised and delisted from HKEx. CVC and Tan Sri Kong emerged post privatisation as the two largest shareholders of Nirvana Asia. Orchid Asia Group which manages US$6 billion in assets with a primary focus in China continues to have a stake in Nirvana Asia according to its website. It was reported that Tan Sri Kong had US$200 million in cash from the CVC buyout while still retaining the second largest stake in Nirvana Asia after CVC.

Management wise, Tan Sri Kong remains the Managing Director and CEO of Nirvana Asia. His two sons, Dato Seri Jeff Kong Yew Foong, 42 (Executive Director and Deputy CEO) and Reeno Kong Yew Lian, 38 ( Executive Director) are actively engaged in the business. Dato’ Seri Jeff Kong has been with Nirvana management since 2003. He has a Bachelor’s degree in commerce from the University of Melbourne, Australia and is an associate member of the Australia Certified Practising Accountant Association (2001). Reeno Kong has been working in Nirvana since 2005. He holds a Bachelor’s degree in Business (Marketing) from Monash University in Melbourne, Australia.

When CVC exits, what then?

In 2018 the Wall Street Journal made mention that London based CVC Capital Partners was planning to sell its stake in Nirvana Asia for about US$1.5billion to US$2 billion. Typical private equity (PE) investments last about 5 years. CVC Capital will sell it to the highest offer received and if it is not another PE fund but to an individual or family business, then the management of Nirvana Asia would likely change to the new controlling shareholder. Its 2020 now and there is no news yet of an exit by CVC but it is to be expected.

Tan Sri Kong has further reduced his stake in Nirvana Asia when it was announced in February 2018 that Baird Capital had bought a stake in Nirvana Asia via a vehicle controlled by Tan Sri Kong. The financial terms of the purchase were not disclosed. Baird is a PE fund that manages more than US$3.8 billion and invested in over 315 portfolio companies.

Read more

- PE Hub. PEI Media Group Publication. Iris Dorbian. 22 February 2018. Baird Capital invests in Nirvana Asia. https://www.pehub.com/baird-capital-invests-nirvana-asia/

- Baird Capital. About Us. https://www.bairdcapital.com/about-us/baird-capital

- Forbes. #20. David Kong. Founder and CEO of Nirvana Asia Ltd. As of 3 April 2020 – US$900m. 2020 Malaysia’s 50 Richest Net Worth. https://www.forbes.com/profile/david-kong/#1a5def7a1744

- Private Equity News. 26 February 2018. Baird Capital Invests in Nirvana Asia. https://www.penews.com/articles/baird-capital-invests-in-nirvana-asia-20180226

- South China Morning Post. 3 April 2019. Georgina Lee. Baird Capital enters southeast Asia with stake in Malaysian bereavement company. The US private equity firm’s investment in Malaysian death care provider Nirvana Asia marks its first deal in the region outside China. https://www.scmp.com/business/companies/article/2140071/baird-capital-enters-southeast-asia-stake-malaysian-bereavement

- Orchid Asia Group. About us. Investment Highlights. http://www.orchidasia.com/index.php?lang=en

- Reuters. 8 July 2016. Sumeet Chatterjee. CVC makes $1.1 billion buyout offer for Asia's largest funeral firm. https://www.reuters.com/article/us-nirvana-asia-cvc-m-a-idUSKCN0ZO1MT

- The Wall Street Journal. 4 July 2016. Wayne Ma. CVC Capital Partners Makes Buyout Offer for Nirvana Asia. https://www.wsj.com/articles/cvc-capital-partners-makes-buyout-offer-for-nirvana-asia-1467630341

- Archipel. Open Edition Journals. Claudine Salmon. From Cemeteries to Luxurious Memorial Parks. With Special Reference to Malaysia and Indonesia. https://journals.openedition.org/archipel/320?lang=en

- Nirvana Asia Group. https://nirvanagroup.my/?gclid=CjwKCAjw19z6BRAYEiwAmo64LWi72iRhNeCtU8kc3dDJQMc4LREwRTZO1Z-rEj-routRHWozf1aYhhoCb4gQAvD_BwE

- Nirvana Asia Group. Company profile. https://nirvana-asia-ltd.com/v2/en/company/company-profile/?gclid=CjwKCAjw19z6BRAYEiwAmo64LQ9C-IIQAahVl6Rxsw7Nrz418yfeQH6yagQMFD8QyZKqDeLEKQbi4RoCQOQQAvD_BwE

- Nirvana Memorial Asia. https://www.nirvanamemorials.com/?gclid=CjwKCAjw19z6BRAYEiwAmo64LSUdv1c6a9ZDNx8Jee6Xi55vCxCC2zXESBuk3wU-x6_xQXcktGZVRBoC7EUQAvD_BwE

- Nirvana Asia Ltd. History and Milestone. https://www.nirvana.com.my/v2/en/company/history-milestone/

- The Star Online. 17 May 2017. Nirvana Founder makes it to Forbes Global Game Changers List. https://www.thestar.com.my/business/business-news/2017/05/17/nirvana-founder-makes-it-to-forbes-global-game-changers-list

- The Star Online. 7 February 2015. Wong Wei-Shen. Nirvana on Expansion Trend. https://www.thestar.com.my/business/business-news/2015/02/07/nirvana-on-expansion-trend

- Entrepreneur Campfire. Lu Wee Tang. Visionary Profile. Kong Hon Kong. Nirvana Asia. https://entrepreneurcampfire.com/kong-hon-kong-nirvana-asia/

- BFM. 9 March 2015. Business of the Final Journey. Jeff Kong. Executive Director. Nirvana Asia Ltd. https://bfm.my/podcast/morning-run/the-breakfast-grille/bg-jeff-kong-nirvana-asia-ltd

- Prestige. 30 March 2016. Julie Yim.Cover Story: Living Matter. Interview with Reeno Kong. https://www.prestigeonline.com/my/people-events/cover-story-living-matter/

- Forbes Asia. November 2016. Neerja Jetley. David Kong’s Funeral Business makes him one of Malaysia’s richest. https://www.forbes.com/sites/neerjajetley/2016/10/26/breaking-a-taboo/#7893376c370e

- CVC. Press Releases. 18 October 2016. CVC Capital Partners completes privatisation of Nirvana Asia Ltd. https://www.cvc.com/media/press-releases/2016/10-18-2016-122800269

- Apex Partners. CVC Explores Sale of Asian Funeral Group Nirvana. WSJ. 19 December 2018. https://apex-partners.com/cvc-explores-sale-for-asian-funeral-group-nirvana-wsj/

- CVC Capital Partners. https://www.cvc.com/

- Nirvana Asia Ltd. Board of Directors and Senior Management. https://www.nirvana.com.my/v2/en/company/board-of-directors/

This article is part of our ongoing research on a book to be published titled “Malaysian Entrepreneurs.” Readers get to read our research online as we do them.