GRAB’s Anthony Tan and His US$40B SPAC Merger

You have to hand it to him. Suave, persuasive, loaded with charisma, Grab’s Anthony Tan can swing a US$40 billion deal that has jaw dropping eyes popping responses among Asia’s tech community. It should be finalised by this last quarter of 2021.

Anthony Tan didn’t choose the direct IPO route for GRAB but a merger with a top SPAC and then go for a Nasdaq listing. Anthony knows the pulse of the investment world. Riding the wave when it comes is the key thing. Asia follows Wall Street. Special Purpose Acquisition Companies (SPAC) are set up to raise capital to acquire private companies. They are also called blank cheque companies because investors give free rein to the SPACs to buy what they want. SPACs are hot on Wall Street and Anthony knows Asia will follow suit. Timing is vital. You don’t want to miss the train. Getting on board the high speed train is his forte. Otherwise GRAB wouldn’t have come this far to be Southeast Asia’s biggest ride hailing-to-food delivery group. Competition is head to head among mobile technology platforms in Asia.

The merger with US based SPAC, Altimeter Growth Capital, was announced in April 2021. It will be the largest SPAC merger valued at about US$40 billion. Taking this route to listing is far quicker than the traditional IPO way. The Grab-Altimeter merger would have a huge cash pile already and is ready to give other investors a chance to buy in and have a stake in the fast-growing ASEAN economy.

Grab’s major shareholders include the Softbank Vision Fund, Uber Technologies, Toyota Motor and Didi Chuxing.

Grab operates in ASEAN which has more than 650 million people (most of them young). Indonesia for example has 270 million people (September 2020) out of which about 50% are millennials and Gen Z (8-39 years old). They are netizens. GRAB net sales for 2021 is expected to be in the range of US$2.1 to US$2.2 billion.

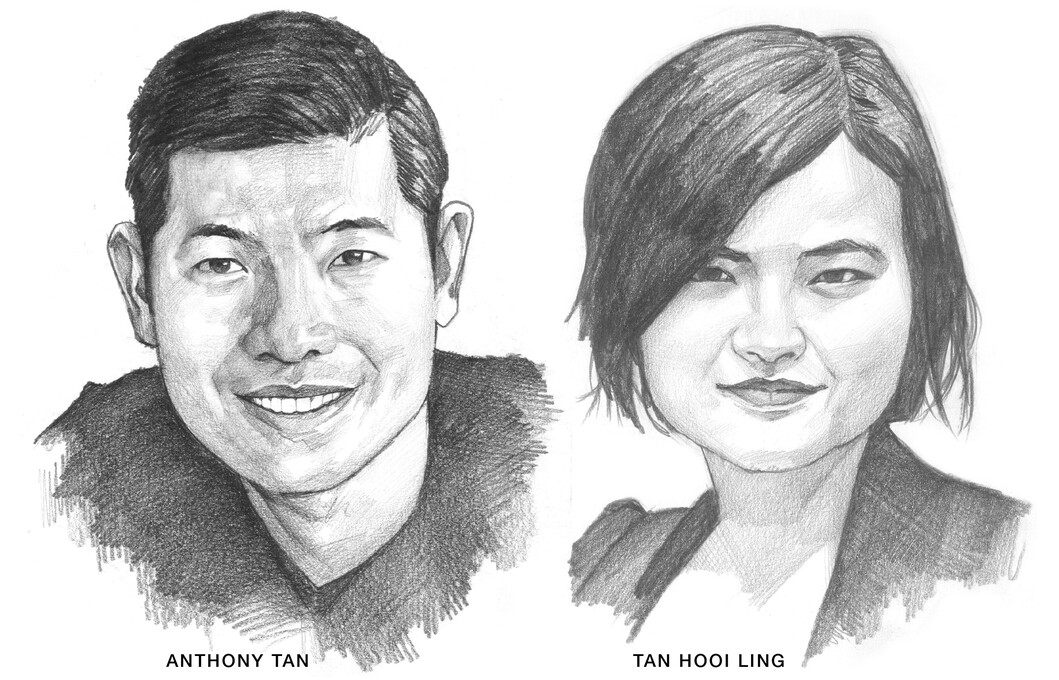

The Amazing Duo

While Grab CEO Anthony Tan jets around the world and does the hectic front-line work of sealing deals, co-founder Tan Hooi Ling works tirelessly behind the scenes as Chief Operating Officer and fire fighter. More introverted by nature, Hooi Ling prefers the back end where she excels better. They complement each other wonderfully.

Beating the family legacy

Anthony Tan is the grandson of Tan Sri Tan Yuet Foh, the co-founder of Tan Chong Motor Holdings Berhad, franchise holder of Nissan vehicles in Malaysia and a conglomerate that engages in the assembly and marketing of motor vehicles, auto parts manufacturing, trading in heavy machineries, industrial equipment and consumer products across borders. He grew up in the motor industry. His father, Dato’ Tan Heng Chew is presently the President of Tan Chong Motor. Anthony Tan has proven that a third generation family heir can outdo the family legacy by breaking new barriers. If his grandfather is alive, he would be very proud of this grandson!

* This article is part of our ongoing research into The New Generation – Malaysian Family Businesses which is a publication planned for 2022 by Sparrow Publishing House.

ACKNOWLEDGEMENTS

- CNBC. 13 April 2021. Riley de Leon. https://www.cnbc.com/2021/04/13/softbank-backed-grab-agrees-to-deal-to-go-public-in-worlds-largest-spac-merger.html

- Reuters. 21 September 2021. https://www.reuters.com/business/grab-trims-full-year-forecasts-says-40-bln-spac-merger-track-2021-09-13/

- The Indonesian Population Census 2020. Highlights. https://unstats.un.org/unsd/demographic-social/meetings/2021/egm-covid19-census-20210209/docs/s03-04-IDN.pdf

- Nikkei Asia. 2 August 2021. Kentaro Iwamoto. https://asia.nikkei.com/Business/Startups/Grab-says-on-track-to-close-SPAC-deal-by-end-of-2021

- Tan Chong Motor Holdings Berhad. https://www.tanchonggroup.com/